IDS share price has suffered a big reversal in the past few days as demand for the stock drops. Shares of Royal Mail’s parent company have retreated to 190p, much lower than the year-to-date high of 260p. It has plunged to the lowest level since November 7.

IDS faces significant challenges

IDS is going through a difficult period as the company’s parcel and letter demand eases. The company’s revenue and profitability has been in a downward trend after peaking during the pandemic. The most recent financial results showed that the company’s revenue dropped from £12.7 billion to £12.04 billion in the last financial year.

As a result, the company sunk to a big loss of £748 million after making an operating profit of over 577 million. This loss was mostly because of the company’s Royal Mail business, which suck into a £1.04 billion loss. GLS, its international business, also saw its profit drop to £296 million. IDS has also seen its debt jump. Net debt rose from £985 million to £1.5 billion.

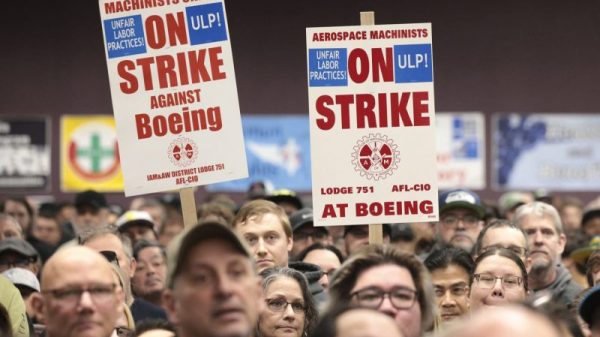

I believe that IDS share price has more downside to go. First, as I wrote in this article, the company is severely overstaffed. The company, which is valued at just £1.9 billionhas over 150k workers. Its total people costs have jumped to more than £5 billion in the past few years. The people cost will likely continue rising after the recent return-to-work formula.

Second, the company is facing strong competition. This week, Amazon announced that it was partnering with Evri – formerly known as Hermes – to assist it with deliveries. The company will also use DPD and Royal Mail. This is an important move since Amazon is one of the biggest parcel players in the UK.

Further, in all, Royal Mail is facing a tough period as its losses and competition in the industry rises. It also pays no dividend, making it an unattractive investment at a time when interest rates are rising.

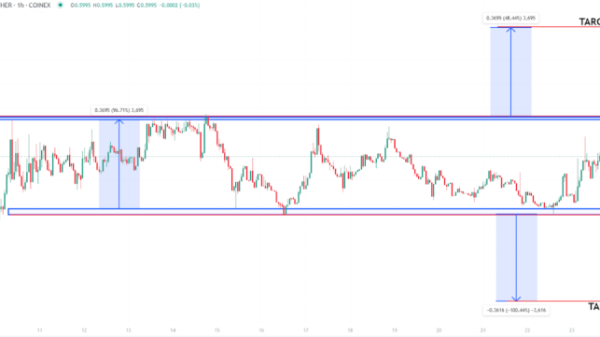

Royal Mail share price forecast

In my last article, I predicted that the IDS stock price would pull back to 173p. This outlook was accurate since the stock has moved from a high of 260p to about 200p. The 25-day and 50-day moving averages have made a bearish crossover and is at the lowest point on December 12.

Therefore, there is a likelihood that the stock will continue falling as sellers target the key support at 173.85, the lowest point in October 18th. This means that it will drop by about 13.5% from the current level. A drop below that level will see it drop to 150p.

The post IDS share price: Here’s why I’d never buy Royal Mail stock appeared first on Invezz.